When Financial Knowledge Counts

The global economy grows increasingly complex. Like reading or writing, economic literacy is an essential life skill. Whether young, old, or older, wealthy or barely making it, married or not

Don’t Panic! Keep Calm and Think Long-Term

People tend to react to uncertainty with irrationality. Over the past few weeks, this has been exemplified by panic buying. We also saw investors backing out of possibly risky assets.

Think Long-Term: Successful Investing is All About Time, Not Timing

When it comes to investing, women are more patient and conservative, and think long-term. The old stock exchange wisdom is true: “Back and forth makes empty pockets”. Every purchase and

Women Mean Business

Governments and private sector players are catching on to what we’ve always known—women are good for business and good for the economy. Women hold roughly 30 percent of private wealth

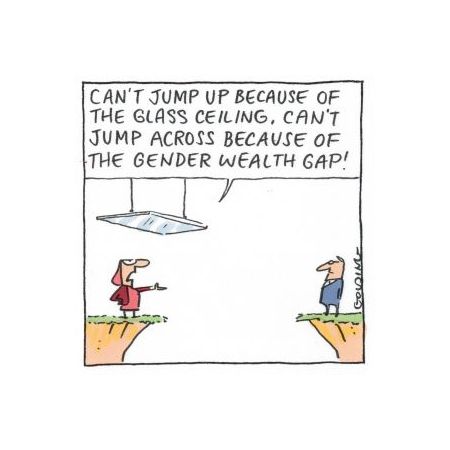

The Gender Wealth Gap

Wealth: The Missing Piece of the Gender Gap Puzzle Awareness of the gap between men and women’s experience of the world and its opportunities has perhaps never been greater—from

Why Mind the Gap?

Ladies, money is power and it’s time to take a place at the table!! That’s where Mind the Gap comes in. We organise events, produce digital series & podcasts to