The Gender Wealth Gap

Wealth: The Missing Piece of the Gender Gap Puzzle

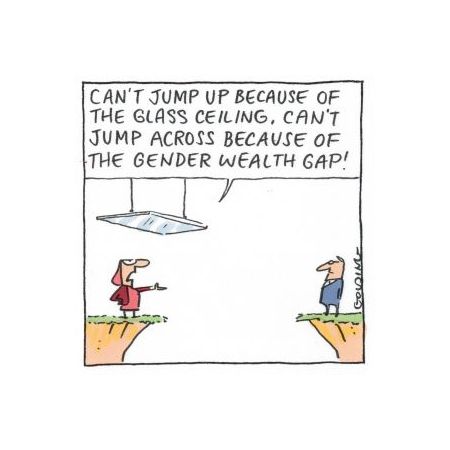

Awareness of the gap between men and women’s experience of the world and its opportunities has perhaps never been greater—from the #MeToo movement and its ongoing ripples of reform, to a swathe of schemes that address income inequality. But what about wealth inequality? Though it gets little attention, the gender wealth gap is an important piece of the puzzle.

The gender gap may be closing, but progress is painfully slow. Huge leaps in the numbers of women in education and employment have not been proportionally represented in the overall difference between men and women’s income. In Germany, women earn on average 21 percent less than men, and are are underrepresented in top jobs across almost all sectors.

Focusing on wealth can help see the picture more clearly, and explain why the gender gap remains so great.

What is wealth and why is it important to the gender gap?

Wealth, by definition, is the difference between an individual’s assets and liabilities. It is also the ability to pay for higher education or an emergency expense, the freedom to buy a home or save for retirement. In short, wealth is security and financial freedom.

“The wealth gap is a much more meaningful gap both in terms of overall economic stability and how well women are able to provide for their own future and their family’s future,” said Mariko Chang, a former sociology professor at Harvard University and author of Shortchanged: Why Women Have Less Wealth and What Can Be Done About It.

Why is there a gender wealth gap?

Women generally earn less, and are more likely to take up part-time work or have career breaks to care for family and do domestic labour. This means that, compared to men, women have less money to invest in the first place—and, due to the long-term nature of those disadvantages, the deficit is compounded over time. What’s more, women have a longer average lifespan and lower incomes in retirement, so must rely even more heavily on savings and investment than men do. When you add it up, it’s not surprising (though still shocking) to learn that 30 percent of women in the EU live in poverty after retirement.

Women make different investment decisions to men.

We live in a man’s world. The entire banking system was built by men, and as such, it remains a place that’s much more weighted towards the lifestyles, priorities and worldviews of the male half of the population. A UBS survey revealed that only one in five women in the US say they are confident about their financial knowledge, and many feel their wealth managers do not understand them or their needs (and they would be right—just 2 percent of wealth managers see women as an audience with specific requirements).

Research suggests that differences in gender perceptions have a real effect on investment decisions. For example, according to a UBS report, “women have a tendency to perceive wealth more as a source of security, rather than an opportunity, and therefore place more value in leaving a legacy to their loved ones.” Studies also show that women are more risk averse—but also that they more disciplined, prefering to invest in companies with a meaningful mission.

How can we close the gender wealth gap?

We can work on income parity, and making the workplace a more just environment for primary caregivers and part-time employees. But there’s something else we can do, right now, to address the gender wealth gap and its implications: Personalised financial advice that’s tailored to women’s lifestyles, concerns and objectives. By investing in strategies that promote asset building, increase financial stability, and help women build a solid financial base for themselves and their families, we can lay the groundwork for true equality.

3 thoughts on “The Gender Wealth Gap”