When Financial Knowledge Counts

The global economy grows increasingly complex. Like reading or writing, economic literacy is an essential life skill. Whether young, old, or older, wealthy or barely making it, married or not

Meet the Mind the Gap Team

Viktorija Kravcova,Karolina Decker, Kirsty Pollock and Leitha Matz (left to right) are the cofounders of Mind the Gap, an organisation dedicated to empowering and encouraging women by sharing knowledge about

Work With Us

There are plenty of ways to engage with us at Mind the Gap, each one a great alignment with our core mission focused on helping women achieve their financial

Women Mean Business

Governments and private sector players are catching on to what we’ve always known—women are good for business and good for the economy. Women hold roughly 30 percent of private wealth

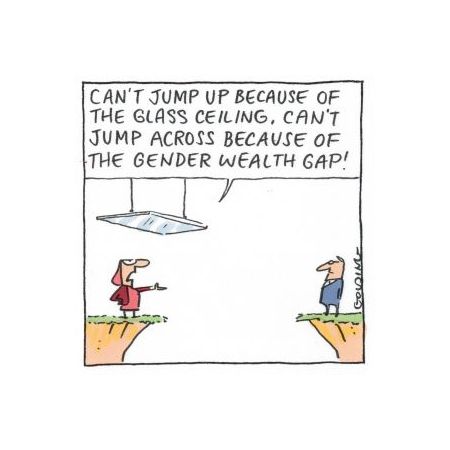

The Gender Wealth Gap

Wealth: The Missing Piece of the Gender Gap Puzzle Awareness of the gap between men and women’s experience of the world and its opportunities has perhaps never been greater—from

Why Mind the Gap?

Ladies, money is power and it’s time to take a place at the table!! That’s where Mind the Gap comes in. We organise events, produce digital series & podcasts to